A good invoicing system – what is that?

As an owner of a business, what are You thinking about when hearing the word ”invoicing”? Does it only mean, writing the debt of Your customer on a piece of paper, hoping that he or she will eventually pay? In the long run, this procedure is not sustainable. In the world of business, invoicing is part of a process consisting of several different steps. This process is usually managed through a sales ledger.

The sales ledger is an important tool for managing sales of goods or services, keeping track of the cash flow as well as the bookkeeping. It is an aid for managing a long process that is to follow certain legal standards in order for everything to be done correctly. There is a huge amount of steps, and it is of importance to keep them under constant track. The first step is, of course, the customer buying a good or service from You. In case he or she is not paying by cash, You are usually sending him or her an invoice.

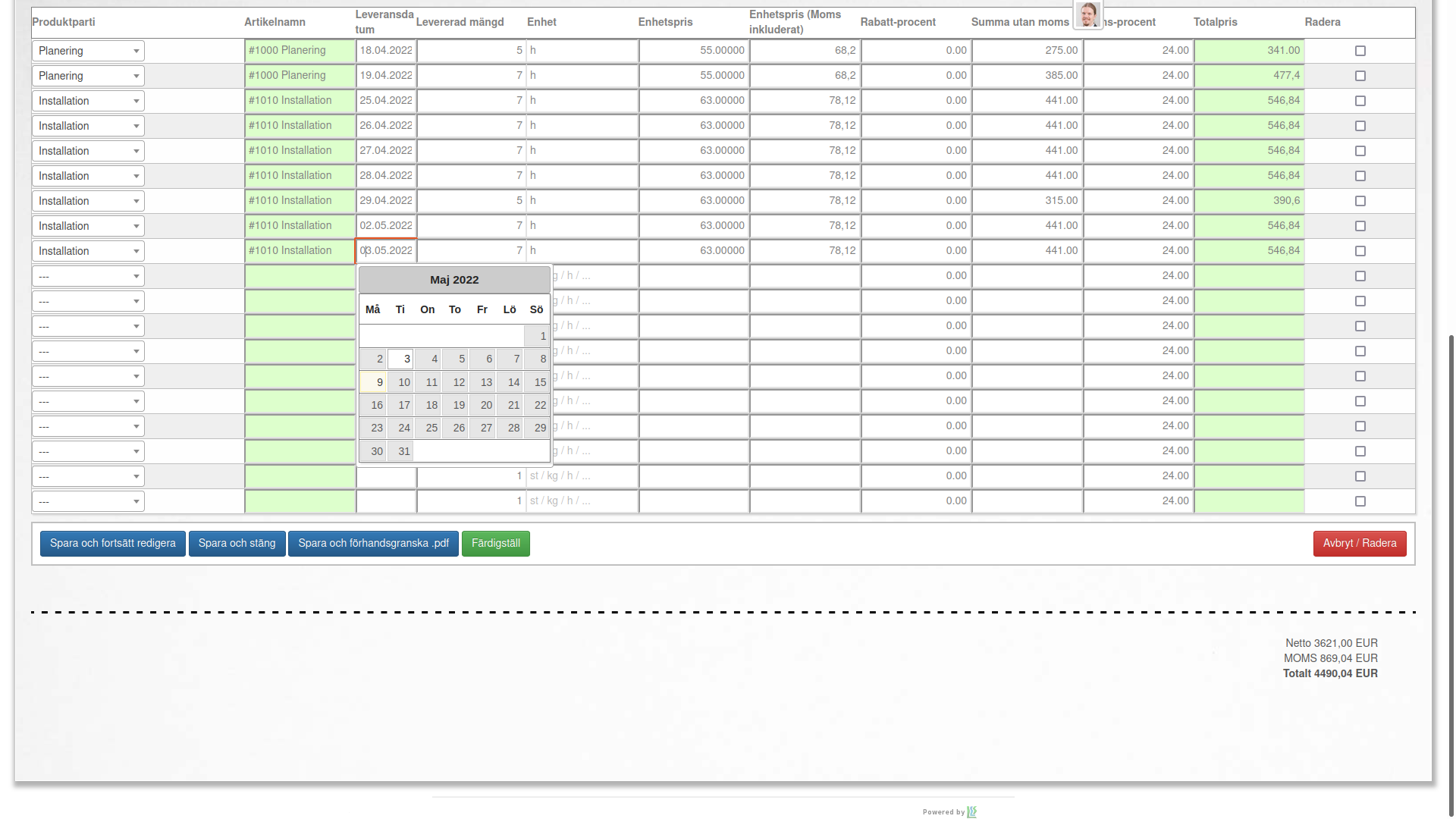

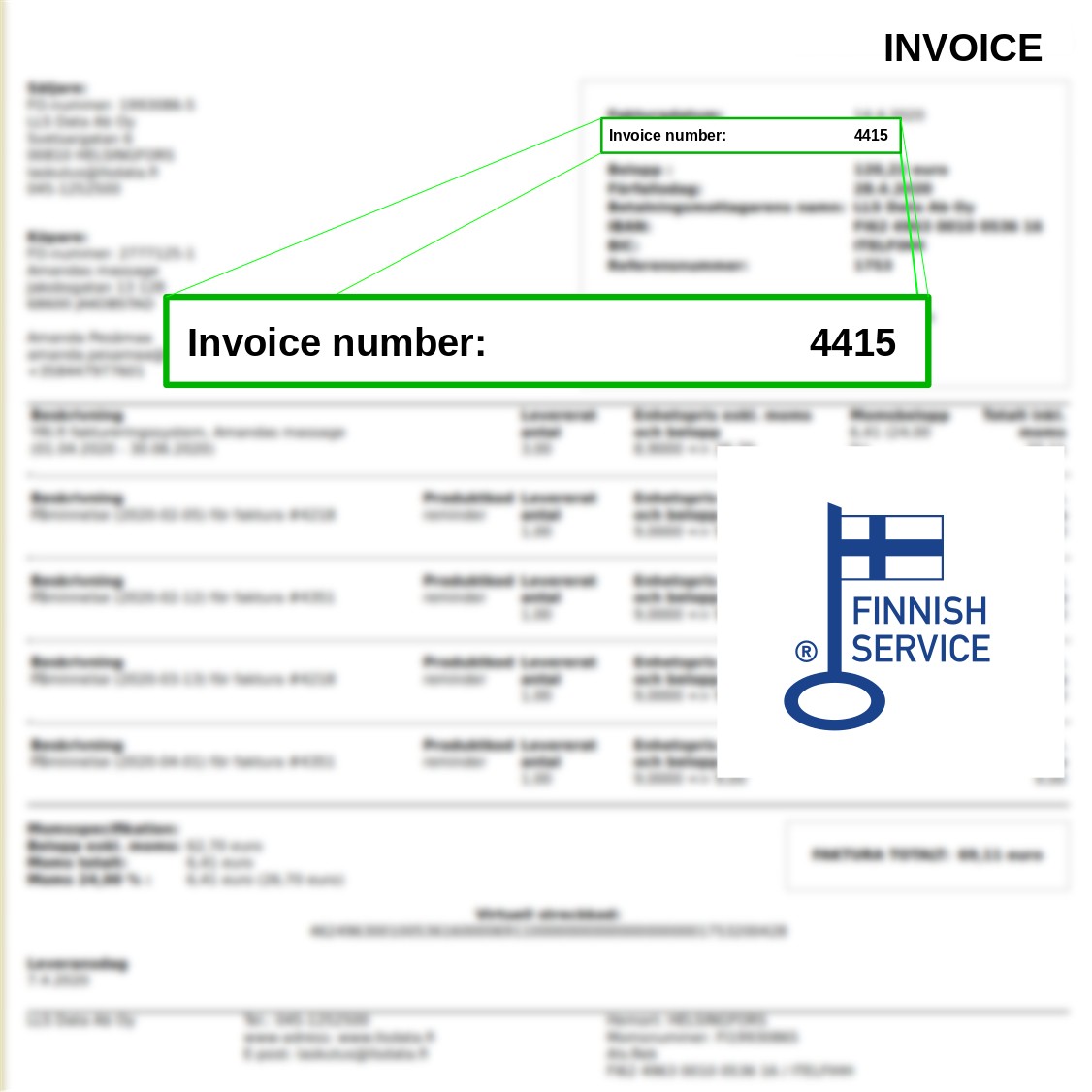

The invoice send is to contain information, among other things about the specific good or service sold, its price, rate of Value Added Tax, invoice date as well as due date. The customer is expected to pay the invoice no later than the due date.

Bookkeeping of invoices

When booking Your invoices there are two general alternatives (please note that this is in the Finnish context). One is that the invoice send is booked as a receivable at the invoice date. As soon as the payment from the customer is received, the payment is booked as a decrease in the receivables. In this way, there will be two (sometimes more) bookkeeping transactions for every invoice.

If using the other alternative, the invoice is booked only when the payment is received. Often, this is a huge benefit for owners of business sending invoices, without being sure whether the payment will be received or not. The Value Added Tax is declared only when the payment is received. Only small businesses are able to use this alternative. More information can be found at the homepages of the Finnish tax administration (in Finnish only)

Reminders and overpayments

When using an efficient invoicing system, You can keep constant track of Your invoices send as well as their expected payment dates. In case the invoice is not paid by the due date, You will be required to send an invoice reminder. For this reminder, You might charge the customer a late payment fee as well as a late payment interest. When using a professional ledger software, the process of keeping track of payments needing a reminder is very convenient.

The case being that customers are often paying excessive amounts, there is also a need for a feature managing overpayments. With the help of that You can keep track of those cases, including the customers and the amounts of the payments. There is also a need for marking a payment (or a part of a payment) as an overpayment, in order to use the excessive amount to cover the next invoice.

Optimicing the invoicing

As shown above, there are several steps in the ledger. While it is possible to manage the process independently in the early stages of the company, it is however, time spend that rather could be used for developing Your own business. As the company is growing, invoicing is soon becoming an extremely time-consuming activity. For this reason, it is extremely beneficial to take an invoicing system into use already in the early days of the company.

There are today several invoicing systems with different solutions. Some are including features only for the process of creating invoices, while others also are including broader options.

When choosing an invoicingsystem, why not choose one that will manage the whole process of the sales ledger, from creating the invoice until the bookeeping, as well as counting the Value Added Tax? Would not the ideal solution be a software where You can create and manage invoices that You will be able to send either as electronic invoices, through email (in PDF-mode) or even printed on a letter? Why not have constant access to a daily automatic update of invoices paid, unpaid and invoices with a due date approaching?

All the processes above can be managed in yri.fi. In addition to that, there are several other smart solutions for managing the ledger. Below You can read more about them.

Integration with Your bank – an automatic fetching of digital bank statements

In order for the ledger system being able to keep track of paid as well as unpaid invoices, it needs information about the payment from the customers. This is usually managed through integration with your bank account. By nighttime, the system is fetching the digital bank statement from the bank. These are read and the transactions related to certain customers as well as there invoices are identified. The payments are also to be taken into account in the bookkeeping.

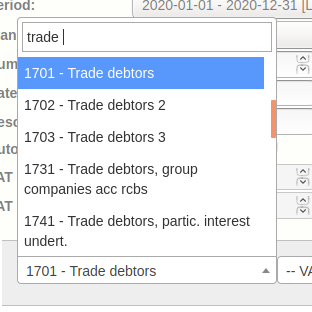

Bookkeeping

You are also able manage Your bookkeeping through yri.fi. A huge benefit with managing both the ledger and bookeeping in the same system is the possibility to automate the bookeeping of Your sales to a large extent. While creating a new invoice, You are also able to manage how it is to be booked, which is a pretty simple, but very important task. That being done, a bookkeeping transaction will automatically be created according to the specific accounts. Please note that this procedure will require You to take the feature for accounting into use as well as invoicing.

Customer register

While creating a new invoice, You are choosing a customer from Your register at the homepage. In case of a completely new customer or one not being in the register, You can create the invoice anyway, but You will be required to add information about the customer, the name being a minimum requirement. In the register, You will be able to keep a constant track of all Your customers as well as every invoice ever send to them. Thanks to that, the process of finding an invoice send to a specific customer is extremely convenient.

Reporting of Value Added Tax

Those days when You were forced to spend huge amounts of time calculating the Value Added Tax are long gone, yri.fi will automatically calculate it for You and create a report. This function is also requiring the feature of accounting. Please note that the Value Added Taxes calculated are for the Finnish market.

Sales reports

As an owner of a business, of course You want to keep Yourself constantly up to date about Your sales. Even this is not a problem, thanks to the feature Sales reports that is automatically creating reports according to some of the following alternatives:

- Customer

- Account in the bookkeeping

- Sales person

It is also possible to check reports for a certain range of time according to Your own needs!

Product catalogue

Thanks to the product catalogue, You are able to create invoices fast and efficient, as the name and price of the products is efficiently added by choosing product. Only the amount needs to be filled in.

Cashier receipt

In case You are selling by cash, You can create a cashier receipt with this feature. This will help You keeping track of Your selling for cash.

Different models and languages

Depending on the customer, You are able to choose the look as well as language of the invoice. It is as also possible to save the invoicing language as a standard language for the customer in question.

Work that usually would take hours to complete, is thanks to the services provided by yri.fi possible to do with only a few clicks. Follow the steps of several other satisfied customers and start using yri.fi, let us help You as well!

Facebook

Facebook LinkedIn

LinkedIn WhatsApp

WhatsApp Telegram

Telegram Twitter

Twitter yri.fi is now a registered trademark in the EU

yri.fi is now a registered trademark in the EU Integration to wholesalers in electricity and plumbing, Onninen, Dahl, Sonepar and Rexel

Integration to wholesalers in electricity and plumbing, Onninen, Dahl, Sonepar and Rexel Intensive and extensive invoicing for wholesalers

Intensive and extensive invoicing for wholesalers LLS Data Ab Oy has been verified as one of Finland's strongest companies!

LLS Data Ab Oy has been verified as one of Finland's strongest companies! Create financial statements directly from the system (v1.3.4)

Create financial statements directly from the system (v1.3.4) Chart of accounts for housing companies (v1.3.3)

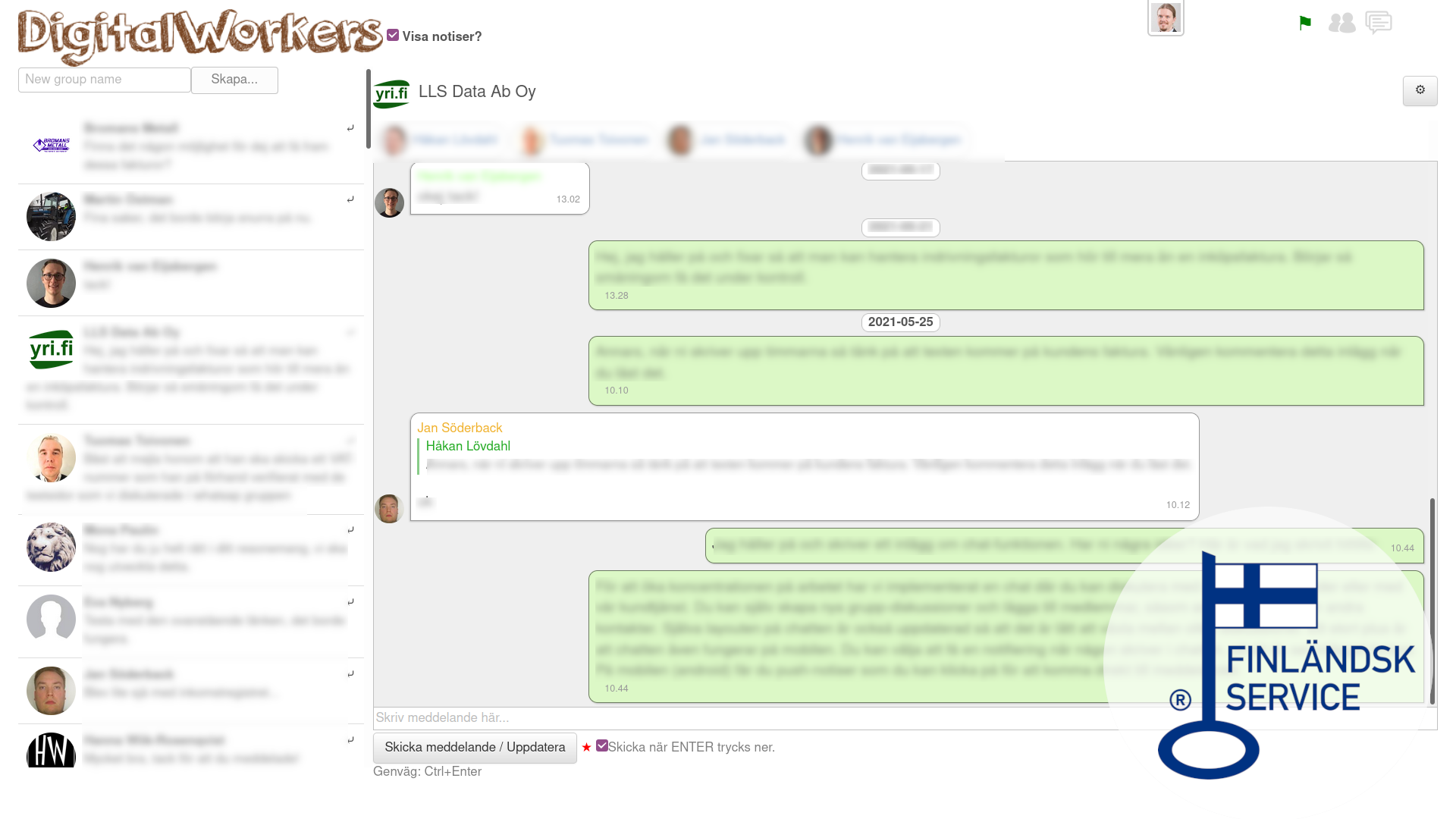

Chart of accounts for housing companies (v1.3.3) Group discussions in the chat (rev. 1.3.2)

Group discussions in the chat (rev. 1.3.2) Revision 1.3.1 - valid HTML5

Revision 1.3.1 - valid HTML5 Revision 1.3

Revision 1.3 Revision 1.2.3 - better handling of bank-transactions and other improvements.

Revision 1.2.3 - better handling of bank-transactions and other improvements. 1.2.2 - Improvements to the invoicing part

1.2.2 - Improvements to the invoicing part 1.2.1 - More efficient entry and editing of accounting transactions

1.2.1 - More efficient entry and editing of accounting transactions Send and receive e-invoices regardless of bank!

Send and receive e-invoices regardless of bank! v 1.2 - Nordea web services integration, retrieval of bank statements in machine readable format

v 1.2 - Nordea web services integration, retrieval of bank statements in machine readable format Revision 1.1.9

Revision 1.1.9 We are looking for firms for evaluation of our accounting-feature

We are looking for firms for evaluation of our accounting-feature We are taking part in Slush!

We are taking part in Slush! Is yri.fi a well-functioning system? Check out what the users think!

Is yri.fi a well-functioning system? Check out what the users think! Create your invoice in Russian

Create your invoice in Russian